best companies to sell covered calls

In theory on the day a company pays a dividend the stock should trade lower by the amount of the dividend because. Ad No Hidden Fees.

Wedding Budget Worksheet Free Download Excel And Google Sheets Options Trading Strategies Call Option Trading Charts

Indeed over the long term these are.

:max_bytes(150000):strip_icc()/dotdash_Final_Call_Apr_2020-02-cf56d3cf2d424ade8f6001fa23883a3c.jpg)

. In this example with XLE trading 6396 shortly before the close on Tuesday the difference in pricing between Calls and Puts was quite pronounced. Well still have made our 53 in cash per contract from this trade. Answer 1 of 3.

A Covered Call or buy-write strategy is used to increase returns on long positions by selling call options in an underlying security you own. BA is a strong candidate for selling covered calls. Open an Account Today.

The covered writers goal. Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account. Ad If you have a 500000 portfolio get this must-read guide by Fisher Investments.

1 During periods of market overvaluation where the market is likely to be flat or down for a while. Covered call writing is not like directional trading in which the goal is to time the movement of a stock. Not from a commission stand-point because there are cheaper services out there but from a spread split standpoint.

Boeing stock is a great security because not only does it deal in defense. XYLD is effectively the same as QYLD except it uses the SP 500 as its core index instead of the SP 500. It is always good to.

Ad Were all about helping you get more from your money. And we can then write a new set of calls. Ad Were all about helping you get more from your money.

A covered call is an options strategy in which the trader holds a long stock position and sells a call option on the same stock in an attempt to generate income. If OHI closes below 39 that day well still own our shares. Covered call strategies are to pick the right company to sell the option on.

Hands down Fidelity is the best. You can also take advantage of the dividend which hovers below 175. There are many factors in choosing a.

In the last trailing year the best-performing Covered Calls ETF was USOI at 3861. Then select the correct strike price. Ad No Hidden Fees.

Best Covered Calls. Boeing Co NYSEBA is a strong candidate for selling covered calls. Since both earnings and dividends are announced quarterly or every three months both of these factors increase the.

As RYLD is one of the only funds selling calls. January 45 - hitting volume resistance. Both online and at these events stock options are consistently a topic of interest.

QYLD is easily the largest covered call ETF out there which shouldnt be surprising given that it uses the Nasdaq 100 as its core index. Look at UBER for. The most recent ETF launched in the Covered Calls space was the Global X Dow 30 Covered Call ETF.

My favorite equities for selling covered calls on are the SPY SPDR SP500 ETF and large quality companies such as Apple and Google. Sign up for the latest on how to invest in Nasdaq-100 Index Options. You purchase 1000 shares of XYZ Corp.

You can generate a ton of income from options. The two most consistently discussed strategies are. Ad Gain access to the Nasdaq-100 Index at 1100th the notional value.

If you are looking for a decent covered call play Oracle may be a very good choice. Simply covered calls work best so long as the. Ad See the options trade you can make today with just 270.

How Does Selling Covered Calls Work. To me the best site for covered calls should have a comprehensive covered call education section. Options Trading For Newbies is written for beginners with small accounts.

Ad Updated daily this list does the work of compiling the best option-able stocks for you. The best times to sell covered calls are. First and foremost you need to do your own research and pick a company that you like enough to want to hold their stock.

If shares trade at 23 and you sell a 3 month call with a 25 strike for 075 you still make 275 on a 23 stock when you are. Selling a 35 call for 150contract in premium on a stock trading at 36. So how does selling covered calls work.

If you are concerned about being put into a position just sell OTM. For example if its 100 300 for the. Click here to learn ways Fisher Investments delivers clearly better money management.

Lets look at the following steps. Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account. Lets get started today.

Because selling covered calls can be a conservative option. But you should be aware that dividends do play a role in call option pricing. If KHC drops the investors break-even price is reduced by the option premium and the dividend.

The Best Covered Call Stock. RYLD sells covered calls on the Russell 2000 index while most other funds sell calls on either the SP 500 or Nasdaq 100 index. 1 Selling covered calls for extra income.

Ad Free book shows how to generate 20196 per day trading options a couple times a week. Profit is limited to strike price of the. Free strategy guide reveals how to start trading options on a shoestring budget.

Covered call writing is a game of regular incremental returns. Many long term covered call writers sell options three months out. The best stock options ranked from 100clear call to -100clear put in one place.

Making Kraft-Heinz stock another one of the best stocks for covered call writing. Covered Call Option Trade. Tesla stands out in BofA list of best covered call options plays.

12 rows Company Symbol. Lets get started today.

/TheBasicsofCoveredCalls-e9b54e56a9c74812b728f6c4585e4192.jpg)

Covered Calls Basics Risks Advantages Overview

7 Best Options Trading Examples 2022 Benzinga

7 Best Options Trading Examples 2022 Benzinga

Best Options Trading Platform For May 2022 The Ascent By Motley Fool

The Poor Man S Covered Call What It Is Why I Don T Use It By Erik Bassett Medium

/TheBasicsofCoveredCalls-e9b54e56a9c74812b728f6c4585e4192.jpg)

Covered Calls Basics Risks Advantages Overview

Covered Call Strategies Covered Call Options The Options Playbook

An Alternative Covered Call Options Trading Strategy

/close-up-of-stock-market-data-on-digital-display-1058454392-9e48e65462e14a04a74008cbe0ec9aa9.jpg)

Covered Calls Basics Risks Advantages Overview

Covered Call Strategies Covered Call Options The Options Playbook

An Alternative Covered Call Options Trading Strategy

/TheBasicsofCoveredCalls-e9b54e56a9c74812b728f6c4585e4192.jpg)

Covered Calls Basics Risks Advantages Overview

Covered Call Definition Practical Example And Scenarios

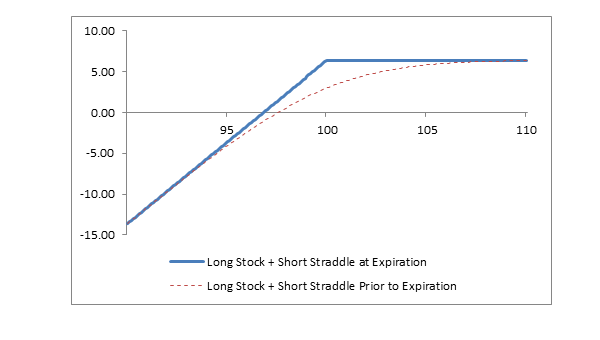

What Is A Covered Straddle Fidelity

The Poor Man S Covered Call What It Is Why I Don T Use It By Erik Bassett Medium

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-02_2-8c2ed26c672f48daaea4185edd149332.png)